Have you ever dreamed of launching your own Tech Startup? Antler is a global Startup generator and Venture Capital firm. They have a game changing approach to nurturing and supporting the next generation of entrepreneurs.

Dexter Cousins of Tier One People interviews Anthony Millet, Partner at Antler to discuss the launch of their first Australian program.

Antler is a start-up generator and early stage VC. Over the next four years we plan to invest in over 200 technology businesses as the first investor. Our strategy is to recruit the top talent in Australia to build businesses with our support and back them from day one. The barriers to entry to build a tech business are lower than they have ever been. Yet the barriers to entrepreneurship are still there. Finding the right co-founder, raising capital, giving up a comfortable job. All of these fears prevent talented people from making the leap and fulfilling their potential.

The Antler program removes these barriers and enables the top talent in Australia to become entrepreneurs. We are de-risking the path to entrepreneurship. Approximately 90% of startups fail and it's really down to one of three things.

Quite frankly, we think these are bullshit reasons for a startup business to fail and in the most part avoidable. Unfortunately, the startup investment community have got into a state of funding too many businesses that are set up for failure from day one. The six-month Antler program identifies and addresses these issues, providing founders with an unprecedented platform designed to heavily mitigate against these unnecessary reasons for failure.

Antler is truly democratising entrepreneurship and we are focused on diversity. There is no set profile for an entrepreneur. The reason we form teams is because we want complementary skill sets, but also complementary personalities.

The first program started June 3 with 70-plus founders in the Sydney Startup Hub. We received more than 1,000 applications. Joining the program are product managers, rocket scientists, and even those who have helped to build international businesses which have reached unicorn status.

With 71 founders officially signed, this first program has also positioned Antler as an industry leader for gender equality with 25% female founders. In 2018, only 2.2% of all VC investment in the US went to female founders. Our first cohort has 25 nationalities represented with an average work experience of 13.5 years. 57% of participants have a commercial background vs. 34% technical background vs. 8% industry experts.

As a young boy I started working in my father's sports retail store in North West London. I became fascinated by business at a young age. My parents never went to university and worked incredibly hard to give me a very privileged upbringing where I could focus on my education. So, my parents were delighted when I came out of the university and joined an investment bank.

I covered the technology sector and was hugely inspired by my clients, who were building tech businesses and taking them through IPO. I was bitten by the bug and decided to quit investment banking and study an MBA. Sat with my parents one day, running a high street retail store, they told me their business wasn’t performing well. But they had just entered the online space and had launched a new website which was generating ten orders per day.

It was such a small component of the business, but I felt there was something there. And having seen the rise of offline to online sales in the technology sector I decided to have a crack and see if I could grow the business.

I postponed my MBA for a year, but one year became five years, in which we grew annual revenue to 35 million pounds and ultimately ended up selling that business to JD sports a FTSE listed sports retailer in the UK.

I am married to an Australian, so we decided to move to Sydney. As I began thinking about my next project, I looked at the local landscape and infrastructure and realised setting up an eRetail business was not feasible. It was cheaper to send a a pair of sneakers from London to Sydney than Melbourne to Sydney!

Having recently grown a business across nine countries I knew the challenges of global growth. So, I decided to focus on a business model with significant domestic potential but have the option for international expansion. I spent a few months researching, met lots of people and recognised the Finance and Property industries were ripe for disruption in Australia.

At that time, I was having a conversation with Markus Kahlbetzer who had this great idea for a property share market. I partnered with Markus and became CEO of BrickX a fractional property investment business. Within 6 months we had launched. Within the first 12 months I had raised over $9m from Reinventure and NAB Ventures. In two and a half years we grew the team and were solving a big problem, helping Australians locked out of the property market invest in property.

The business grew to the point where I felt my skills were not best suited to take the business on the next phase of the journey. My expertise lies in startups and BrickX was now well established. It was the right time to step aside.

I’d recently become a Dad and planned to take time out. Two weeks into my sabbatical, a friend tapped me on the shoulder and asked me to look at Antler. It was an opportunity too unique to ignore and the most impactful VC project that I have seen in Australia in the last four years.

Antler is an opportunity to help make Australia a global leader in startup ecosystems. As a country we are doing okay but I feel we can do so much better. Australia ranks no11 in the world for research & innovation. Ideas and talent are not the problem. But commercialising ideas is a major problem for Australia and we rank much lower on a global scale.

Clearly, the ecosystem has to work together to help great ideas become great businesses. The bar needs to be raised when it comes to entrepreneurship in Australia. It is a simple equation. Quality in = Quality out.

I'm excited about the impact Antler will have on the entire country. We believe our approach will raise the standards of startups in Australia and create a lot of new jobs. Most importantly, over the next four years we are dislodging 800 high impact people from low-impact roles to build a large number of phenomenal companies.

The first program begins in June 2019 in Sydney and we will run the program every six months for four years. Come June, up to one hundred talented people across multiple industries and sectors will start the flagship program. The first two months of the program is based around matching co-founders. Finding the right one or two people with complementary skills who get on and share an interest or passion to build a really awesome business.

One hundred people could come up with 500 ideas. That’s great, but we encourage everyone in the program to be open minded and drop their idea if something better comes along. Through a process of daily hackathons, forming teams, breaking up teams, consistently testing ideas we believe after two months we can form the optimal founder teams with strong idea validation.

At the end of the two-month co-founding period, teams present their business idea and business model to our investment committee. If we believe in a founder team and their idea then we invest $100,000 to start the business for a 10 per cent stake. Out of 45 teams we intend to invest in 20 or 30 of them. Every program participant is paid $4000 per month in the initial two-month period. We are truly de-risking the path to entrepreneurship

When you consider that many of the ideas we invest in will only be a few weeks old, we are investing in the people first. Then providing the resources and support to turn an idea into a successful, scalable technology business.

During the four-month building process, teams are provided with the support to build an MVP and get as much validation as possible. No one's wasting any time fundraising at any point through the program. At the end of the 6-month program each team will get to present their business to over 500 investors from around the globe.

We are taking a global view from day one. The ideas we invest in will have the potential to scale globally. Antler is live in Stockholm and Singapore. London and Amsterdam go live in May, Sydney goes live in June. September, the program launches in New York and Nairobi.

With the Antler programs in 7 countries and plans for up to 20 cities live within 18 months, we see a huge opportunity to collaborate on a global scale.

Antler is truly democratising entrepreneurship and we are focused on diversity. There is no set profile for an entrepreneur. The reason we form teams is because we want complementary skill sets, but also complementary personalities.

If we look at the first intake the average number of years work experience for people coming into a program is fourteen. Typically, cohort members have operated just below C-Level, where they have seen all the action but not always been recognised and rewarded for their efforts. The people we have chosen are highly talented, experienced and motivated people who have a strong desire to come together and build next generation Tech businesses. Although we are tech agnostic Proptech, Fintech, Regtech, Agritech, Cyber Security, Martech and Edtech are the areas we expect will produce the most business ideas.

When we're interviewing people coming into the program, we are mostly interested in the people not the idea. What we're really assessing is the impact they've had at work, what they've personally accomplished and some of the challenges they've faced in their life. We are looking for significant examples of drive, resilience, grit, tenacity and entrepreneurship.

I'm very careful to not try and sell the program. This is about us creating a clear path to entrepreneurship, but individuals need to self select themselves to take the step in to such a program. If you are someone who is a high achiever, with entrepreneurial flair, but you've been held back because you haven't found that right person, or financial circumstances. Then, Antler could be the opportunity for you to finally test your own personal limits and co-found a business.

Applications for the June cohort have now closed, but we are now recruiting for the January 2020 cohort – you can apply at www.antler.co. You can also find out more information about founder events and learn more on the website. To see our current cohort for June 2019 visits www.antler.dev

People warned me that building a bank would be very difficult. But it is much, much harder than that!

Steve Weston. CEO, Volt Bank.

Steve Weston is CEO of Volt Bank, the first fully licensed Neobank in Australia. Tier One People CEO Dexter Cousins caught up with Steve at Volt Banks HQ in Sydney to talk everything digital banking.

Steve: I started my banking career at the age of fifteen in a small town in North Queensland. It was a great introduction to banking and the important role banks play in the community. Fast forward 30 years and I found myself in the UK as part of the senior leadership team at Barclays in a very similar environment the banks in Australia are facing post the Royal Commission. Somehow banks today have lost their purpose for existing, which is to serve customers.

At Barclays, I experienced first hand what happens when banks don't do the right thing by their customers. I also experienced the challenges incumbent banks face when attempting to adapt to the digital and data driven world we now live in.

When I came back to Australia in the beginning of 2016, I spoke with boards and executives of at least a dozen banks on two topics. Firstly the change in regulation; I was confident that they could see what had transpired in the UK post-GFC was likely to happen in Australia. Secondly, the need for digital transformation; Barclays is recognised as a leader in digital transformation amongst incumbent banks globally.

The banks found my insights interesting but also too challenging to action. I think if I had joined a major Australian bank I might have only lasted a couple of weeks. My opinions were strong on what was likely to happen and what needed to be done, I would most likely have been considered too much trouble! Instead I decided to take a different route - I joined the board of a peer-to-peer lender and invested in a few Fintech startups.

Then one day I bumped into an old St George colleague of mine, Luke Bunbury, who is now my Co-Founder of Volt Bank. Like most businesses, the Volt Bank idea started by putting the world to rights over a bottle of red and a pizza!

Luke and I both agreed that the future of banking was digital with clear examples of new entrants in the UK market such as Monzo, Starling and Revolut. The barriers to entry in Australia were incredibly high, even if we had the significant capital required, the chance of ever getting a banking licence was remote. So, we just parked the idea and got on with life.

A day I vividly remember is May the 9th 2017. I was watching the federal budget on TV, Australia’s Prime Minister, Scott Morrison, the Treasurer at the time, announced key changes to the Australian banking regulations. He called for an open banking review, announced the BEAR (Bank Executive Accountability Regime) act, the Banking Levy and most importantly for us, the restricted banking licence approach. A similar approach to phased licencing in the UK made it possible for Monzo, Starling and the UK neo bank revolution to get off the ground.

I didn't sleep that night and wrote what was to become a business plan. I met with Luke the next morning and we agreed to commit to a six-week feasibility study to assess the viability of building a neobank in Australia. We reached out to nine other colleagues to ask if they could help. By June 2017 we made the decision to form Volt Bank and all nine are still members of the team.

People warned me that building a bank would be very difficult. But it is much, much harder than that!

We applied for a restricted banking licence in October 2017, were granted that licence 7 months later in May 2018 and consequently granted a full banking license in January 2019. We are unaware of any bank; even multinational banks being granted a full Australian banking licence in less than that time. Whilst it has been challenging, it has been an amazingly rewarding experience.

"Being awarded a banking licence is an extremely difficult and rigorous process, and so it should be."

Steve Weston - Volt Bank

First you need a deeply experienced board and management team in place. I am regularly asked for advice on how to start a neobank and get a licence. Most of the people who are thinking about building a bank I meet come from technology or M&A backgrounds. The harsh reality is they will struggle to get a banking licence and will likely burn through any capital they raise unless they have all the ingredients in place.

We have met with people who have started the process of a restricted license and then pulled out because of how difficult it is. Before anyone starts, I would encourage them to speak with people at Xinja, 86:400 and Judo Bank.

The execution risk of any startup is high, but in building a digital bank, the risk is extremely high. Without a banking licence, you can’t conduct business. You need all your technology in place, an experienced board and significant amounts of capital. It is a huge investment before you can even sell a product or service.

There’s no secret. We have worn out a lot of shoe leather! I think our proposition is compelling. The UK is a comparable banking market to Australia and if we look at the digital banking scene there, 1 in 4 millennials has an account with a neobank, all in the space of approximately three years. Awareness and growth is increasing at an exponential rate with people looking for a genuine alternative to the incumbent banks.

Cloud Technology and data analytics enable pure digital banks to provide a superior service at a much lower cost, which is obviously an attraction to customers and investors.

The Royal Commission has helped raise awareness that the traditional banking model isn’t working for many customers, and alternative solutions are required. We don't expect customers will simply switch banks because of the Royal Commission. However, research shows that Australian millennials are the most likely millennial group on the planet to switch and the most worried about their financial future. While mum and dad may have grumbled about their bank, they seldom changed. Millennials think and act differently, loyalty is no longer a key element in the decision process.

Investors hear our story and it makes sense to even the most skeptical of fund managers. Now, some might want to see runs on the board before investing. But many have invested on the strength of our story, the strategy we have in place and the background and experience of our management team and board. The fact we have delivered on timelines, especially getting a banking licence, has instilled a lot of confidence in the investor community.

It has had some influence, but we have looked at many neo-banks all across the world to see what they have done well and what we can do better. We have opened accounts with them and spoken to founders where we can.

For 600 years banking largely has been done the same way. You go to a bank branch, get a deposit account or loan product and once the exchange happens you are left to get on with life. Our customer research indicates people want a bank that understands what they are trying to achieve in their lives and help them along the way. We call these ‘journeys.’ Customers want a bank to assist them in achieving outcomes in a more effective way than has been possible in the past.

Rather than just providing a savings account, Volt Bank seeks to understand what it is a customer is saving for and helps them budget, save and develop habits to get there. The Volt app will analyse spending habits and monthly living costs and provide real time prompts when a customer is over spending.

Customers are telling us that they want even more than this. If we can in some way save them money or provide access to a better deal, then they want to hear about it. Customers today expect banks to provide them with suggestions on how to save. A way would be to offer a better deal on non-bank products like utilities, insurance and mobile phone plans. Volt Bank’s key point of differentiation is to help customers in this more holistic way.

It would be naive of Volt Bank to think we can compete against multi-billion-dollar corporations. The major Australian banks have 80% market share, so there is plenty of opportunity for Volt to capture some of that market with direct customer acquisition.

People immediately assume Amazon, Facebook, Google etc. will be the biggest threat, and we recognise that the tech firms may potentially want to offer banking products to their customer bases. However, while large tech firms may have the capital required to become a bank, it is also comes with a lot of pain and regulatory scrutiny, and detracts from their core business. More often they look to partnerships as we have seen with Apple and Goldman Sachs.

Volt Bank has three partnerships announced to date, one of which is PayPal that has over 7 million Australian users. In the coming months we expect to announce other partnerships with businesses with highly engaged customer bases, which are looking to expand their services. We have put in place a business model, technology and experienced people to provide a platform for partner banking. It is a different approach, but we think the market globally and particularly in Australia, is ready for it.

Currently there are 120 full time and contract staff. In 12 months’ time, we expect to have around 200 people. Volt Bank will never employ the number of people a major bank does. By adopting a scalable model with the help of automation and technology we will be able to keep our head count low. However, machines can’t do everything and when it comes to customer contact, we feel it is essential customers deal with humans when they need to. This is why customers of Volt Bank will get to deal with highly skilled customer service representatives.

Yes, and no. We have roles that you would find in any other bank; treasury, risk, cyber security, compliance and so forth. Then we have the creative and tech teams. Designers, engineers and creatives are all on one floor and it is a different environment. There is also a startup hub which is essentially our lab area.

There is a balance between being a bank and tech startup, with a lot of respect between the different teams. Everyone in the business knows that without the banking and risk discipline, we wouldn't have a banking licence, however that we're not going to become successful by operating and thinking like a traditional bank.

And that's why we have recruited people from different industries and from different countries, people at the top of their game who have a burning desire to transform the way banking is done.

The culture of any organisation is formed from the top of the business. I am fortunate that I love people, love customers and I am a bit of a sticky beak. I try to say good morning to everyone I see each day, and goodbye when I'm leaving to those still in the office.

I know everyone by name, I get to know a bit about them, and I want people to feel comfortable so they can speak with anyone in the business about anything, positive or negative. We get together regularly as a complete team and discuss challenges and achievements, communicate which decisions have been made and why we prioritised those decisions. It is a very open and collaborative environment.

It is critical we invest in our people. We work hard to ensure everyone at Volt Bank understands our purpose and why we go to work every day. We set clear expectations as to what is expected from each team member,and we talk regularly about any mistakes that may have been made to learn from them. We want our people to feel they can be their true self when they come to work.

Coming to work every day is a lot of fun. It doesn't mean the work isn't hard and it doesn't mean that everything's perfect. But we are building something unique, the culture feels more like an elite sports team trying to win the championship than a business at times. That level of commitment, character, drive, determination and skill is the kind of culture we want at Volt Bank.

The original nine people who helped bring the idea of Volt Bank to life with Luke and myself have been the key. Almost all of our hires to date have come from our networks. When we formed Volt Bank, we had founding members in the UK, Singapore and the USA. We have been able to tap into some of the best talent in the world.

We get a lot of interest from people approaching us direct. We assess talent on a combination of technical skills, attitude and cultural fit. Typically, highly talented people will come into an organisation and they want to do a diagnostic for a few months, see what's going on, and then make decisions on what needs to happen.

Because we were growing so quickly and because there is so much to do, we can't afford that luxury. We need people who can fly the plane as we are building it. What do I mean by that? We value talent and expertise, but our people have to adopt the lean startup mentality of building, learning and fixing along the way. And that is a very different way of working to traditional banks and corporates. Even highly talented people can find a new environment challenging so it is about finding a balance while people get used to our way of working. But not everyone can or wants to work this way. So, we are very particular about who we hire and why.

Anthony Quinn is founder and CEO of Arctic Intelligence, one of Australia's first Regtech startups. Anthony and the team have developed a platform that tackles the global problem of financial crime and money laundering. Dexter Cousins, CEO of Tier One People caught up with Anthony to talk about the journey so far.

We specialise in audit risk and compliance software, predominantly in the final crime prevention space. One of our platform solutions is AML Accelerate, which is a cloud-based money laundering and terrorism financing risk assessment platform, that caters to 30 different financial and non-financial industry sectors and contains an AML Program tailored to the laws of over 10 countries

We've got a very diverse client base on AML Accelerate including some larger financial institutions like Suncorp, CUA, TAL, smaller financial institutions like the challenger banks, Xinja, Volt and 86:400, digital currencies, money remitters, non-bank lenders, as well as non-financial sectors including lawyers, accountants, real-estate agents and various pubs and clubs.

We also have developed two other platforms, another Risk Assessment Platform that we are about to launch. It is aimed at sophisticated financial institutions, major corporations and professional services firms and is a risk agnostic, flexible and highly configurable platform. The risk framework, risk and controls assessment and methodology can be adjusted to suit any company.

The other platform is Health Check which caters for regulated businesses and their professional advisers. The platform assesses the design and operational effectiveness of compliance programs through rigorous controls testing, which is used by clients like Deloitte on their engagements.

I spent 20 years consulting to investment, and retail banks first in the UK. I moved to Australia in 2003 running a number of risk and compliance programs for different banks. Over the last 10 years I specialised in financial crime and was the program director running the AML and FATCA programme for Macquaries Banking and Financial Services Group. I developed a deep interest in solving the financial crime problem. Many of the challenges regulated businesses have in managing their risk and compliance obligations stem from the fact that many of these processes are manual.

So, I set about building a platform to make it easy for regulated businesses of all sizes, sectors and geographies to conduct financial crime risk assessments and build effective control frameworks to mitigate and manage their risks.

There was a huge gap in the market that no one was addressing. Money laundering risk assessments and AML programs have to be signed off by the board, with significant consequences for board directors and companies in the form of millions of dollars in civil penalties.

CBA’s $700m fine (which highlighted among many other things, deficiencies in product risk assessment), the royal commission into banking misconduct and the rise of the board executive accountability regime make it clear organisations can no longer rely on outdated spreadsheets to manage a very important risk category.

Arctic Intelligence started as a side hustle, like most startups do. For two years, I was developing the business while working four days a week with Macquarie. I personally funded the initial development of the platform, working with a development team to build an MVP. At the end of 2015, I finished up with Macquarie and went full time with Arctic Intelligence.

We were one of the first residents at Stone and Chalk. Then in August 2016, we won our first client, Deloitte, and then from there the business has just kept growing. We're 17 full-time staff at the moment, mostly based in Stone and Chalk but we do have a couple of people as Business Development Managers in Singapore and the UK.

First of all, as a startup we need people who are multi-talented. But we are broadly split across three main areas. Our Chief Operating Officer, Darren Cade looks after our operations, client services, HR, finance and content management activities.

We've got a sales and marketing team led by Imelda Newton. Her team is responsible for winning new clients and building relationships with consulting firms of all sizes plus establishing and maintaining active reseller relationships.

Then we have the product and technology team, headed by Nathan Zaetta our Chief Technology Officer and supported by a Head of Product, Tammy Goodman and Development Lead, David Stephen. They lead the requirements gathering and software development across our three platforms and manage the testing team which we've got in-house.

Under each of these teams we are supported by a very enthusiastic and high-performing team, as well as a very experienced Board, Advisory Group and Investor base.

The challenges you face in being a startup, is that most people with experience would be mad to join in some ways. Myself and some of the people we've hired could earn a salary of over $400,000 at one of the banks. It’s a tough sell to entice people to leave that comfort and join a startup for 75% less than they are currently earning on a promise of changing the world!

So, you've got to have the right people with the right attitude. Most importantly, anyone you hire needs to clearly understand what they are letting themselves in for. We hire people who are passionate about the vision and can see where the business will be in a few years time. But even that isn’t enough. The people we hire need to demonstrate how instrumental they can be in making the vision come to life. Startup businesses are pretty tough at the beginning.

Can-do attitude is important, You can’t be political or too precious in a startup. We are building a team of high performers. We have been very selective with the people we have hired . We are very lucky to have high calibre people on the team.

We’ve done a couple of investor rounds which were targeted to private investors. That process not only brought in funding but gave access to investor networks. That is how we have assembled an impressive board. We have the ex Chair of PWC Australia as Chairman, Neil Helm, the ex-CEO of OFX is a director. Our board and investor network are all very deeply experienced and well connected, so we leverage that whenever we can.

It’s funny. When we launched RegTech wasn’t even a term. The Regtech Association came together about 18 months ago. A small group of startups were out promoting the benefits of RegTech and highlighting the need for change. We really struggled initially to get momentum, primarily because the care factor of AML compliance was so low.

Fines and penalties for non compliance were very low, the biggest fine was $300,000. And the likelihood of a regulator taking a business to court was virtually non-existent. The big shift started when CBA were fined $700 million, and the Royal Commission into banking misconduct. There is now a lot of demand for RegTech solutions.

Arctic Intelligence were one of the first nine founding members of the RegTech Association. It has been overwhelming how positive the association has been received and much of the credit should go to Deborah Young, the CEO for driving this forward. At the last conference in March 2019 we had 105 startup and corporate members and sponsors. So it's definitely taken on a life of its own and the conversations are really starting to happen in major firms that may not have considered the value of regulatory technology.

There's certainly a lot of good use cases and testimonials and some really good early adopters of the latest technology. We have noticed a significant uptake in our business and see this continuing to gain momentum.

What is the opportunity for RegTech in Australia to compete globally?

I think what we've got going for us is that it is a small market, but it's a very open environment. We have Tech hubs like Stone and Chalk, Tank Stream Labs, Fishburners etc fostering innovation in RegTech and FinTech. But we also have very open and engaged regulatory authorities such as AUSTRAC and ASIC. They are running regular update meetings and have developed an outreach programme to RegTech startups.

The regulators are now very open to RegTech and frankly I think they need it as much as the banks do. If you look at a regulator like AUSTRAC, they've got 300 staff to monitor 14,000 regulated businesses. This number will increase to approximately 85,000 businesses in 2020. Without technology it is not feasible that regulators can effectively regulate - they are resource constrained and losing the battle, they have to be smart about supporting technology innovation but also become adopters themselves. I offered our technology to one of the regulators for free, over 4 years ago but nobody has taken up this offer.

It's a great eco-system where you've got regulators, regulatory bodies, professional services firms and tech providers collaborating together, challenging each other on the art of the possible. It is leading to rapid innovation and proving what can be achieved. Everyone is going on their own journey with RegTech, which gives us all a much deeper understanding of multiple perspectives.

I think this is the key reason why Australian RegTech seems to be standing out globally.

We are about to launch, another risk assessment platform, which is domain agnostic. So it can do much more than Anti Money Laundering. The new platform has multiple use cases including bribery, fraud, cyber, operational risk or any risk domain. It allows a lot more flexibility in terms of being able to introduce risk models or control frameworks, add relative weighting of risks and controls, changing methodologies.

We’ve developed a very flexible risk platform primarily aimed at sophisticated reporting entities like major banks. Believe it or not, most of the major banks we work with in Australia and overseas are still managing financial crime and AML risk assessments on spreadsheets. The platform takes the data in those spreadsheets and puts it into a robust risk assessment framework.

The platform is geared towards regulated businesses and the professional services community. Deloitte are white labelling our technology. We are in a beta test program, which is a global program with about 25 different stakeholders in the UK, Canada, the US, Southeast Asia and Australia.

We feel like we're at the bottom of the mountain, even though we've been going for quite some time. There's a lot of growth potential for us in terms of growing into new markets, growing into new industry sectors and growing across our product ranges.

We think we're just at the start and the sky’s the limit, so we are really pumped to get out there and make a difference. And ultimately it is about trying to do our bit to help solve the money laundering problem and the social impact that causes - violence on our streets, rampant ice addiction in Australian cities and country towns, increase in crime rates, domestic violence and broken families.

That is our higher purpose and the thing that really drives us.

As CEO of 11:FS Foundry, Leda is at the forefront of innovation in open banking. She’s also Chief of Staff for 11:FS Group, a specialist digital financial services firm that is reinventing what providing advisory, technology and design services to the banking community looks like.

Leda is a renowned speaker, writer and academic in banking and fintech, and an expert in digital disruption, strategy and financial technology. She was recently named in the top 50 Senior Female Leaders in Global Fintech. Tier One People CEO, Dexter Cousins caught up with Leda to talk all things 11:FS and Will.I.am?!

At a high level, 11:FS is essentially a set of capabilities united by a common purpose. What do I mean by that? We have structured the business very deliberately around the way customers engage with and purchase financial services in the digital age.

Our business model consists of Media (content, podcast and events), Research and Benchmarking (market, product and competitor analysis), Consulting Services and the Foundry Platform. We build digitally native propositions for banks and financial institutions. As an example, we launched Mettle, an SME challenger proposition delivered for NatWest.

The Executive Leadership Team at 11:FS are ex bankers. Remembering back to when we worked in large banks, when it came to innovation, there would be regular meetings where everyone got excited by the question ‘Wouldn’t it cool if ….?’

Sadly, few if any of the ideas ever came to realisation. 11:FS exists to help financial services firms bring these ideas to life and build entirely new propositions with a digital first approach. We are a completely different kind of consultancy because our focus is on execution. And we spend our client’s money like it was our own, with every single dollar budgeted for up front.

11:FS Foundry is a game changing banking platform we are building in partnership with DNB bank. Today’s banking systems were built in the past and for the past. They worked in their day, but they’re no longer fit for purpose in the digital age. The Royal Commission in Australia highlighted many of the problems legacy systems create for large financial institutions.

Banks are spending billions keeping their legacy architecture on life support rather than truly transforming their services. Why? Because changing a core banking platform is staggeringly expensive, time-consuming and risky. We built 11:FS Foundry to enable banks to modernise systems without needing to replace everything at once.

It is a ledger first core banking platform with a modular stack. Which gives technology teams agility and flexibility, they can add modules as and when they need them.

The platform will launch soon. And the partnership with DNB is working beyond our expectations. We are really excited and see huge potential for 11:FS Foundry as we enter a new era of open banking.

That is a tough question. Open Banking should, in theory, create more competition. But I think it would be unwise to look at the UK and expect things to play out the same way in Australia.

Australia has 4 banks sharing 85% of the market. That kind of influence makes it very difficult for challenger banks, Neo Banks and Fintechs to pose a significant threat. International banks with deeper pockets have tried and failed to crack the Australian market. It isn’t easy.

Maybe Australia’s proximity to Asia is the game changer. Do Aussie Fintech’s use all their resources taking on the Big 4 banks, or do they put the same energy into Asia? It is a far bigger market. When I was last in Sydney for Sibos, the level of innovation in areas like RegTech, Data and Identity impressed me.

The podcast recently hit 300 episodes. It definitely builds our profile, but it also builds a vibrant community much beyond our brand. In fact, the greatest benefit of the podcast is the community we’ve built. The 11:FS community is global and the show is a great vehicle to share our message. But, if you listen to the podcasts, it is not about us. It is about the people in the industry, it’s about the community, it’s about giving Fintech’s a platform, a voice.

And for people in the banking industry the show helps by cutting through the noise and demystifying what is a confusing period. There is more noise in the industry than ever. Blockchain, AI, Fintech, Crypto, Cyber Security, Open Banking, API’s; Banking executives rightly feel confused. So, the podcast is a platform to share insights, knowledge and ideas.

As an example, we hosted AfterDark, an evening event at Level 39 in London. Over 200 guests turned up. A guest I invited (a highly influential global banker) came to me afterwards and said “I don’t know what impressed me most. The fact that so many people turned up in the awful weather. Or, the fact there are so many influential and heavy hitting people from Banking and Fintech in the room.”

Banking executives clearly want to embrace change and innovation. But they need the right information, insights and strategies. Do they get the right strategies from traditional consultancies? Or do they turn to 11:FS who know Fintech and have built digital banks like Monzo?

We believe that Digital Banking is only 1% finished. There is so much more we can do and are doing for our clients.

The Co-Founders and I had known each other for a couple of years before me coming on board. We would regularly bump into each other at industry events or when I was a guest on the Fintech Insider podcast. It was clear we shared similar views on how digital banking should be done.

So, when David approached me, it just seemed like a natural next step. He is an inspiring leader and he has created a simple culture and philosophy that resonates. Importantly for me, it’s a high-performance culture, modelled on sports, teamwork and winning. But it is not a ‘win at all costs’ mentality. We have one golden rule ‘don’t be a dick’. It sounds simple, but regularly reminding ourselves of this one sentence nips arguments and politics in the bud.

At 11:FS I get to work with and meet amazing people. Had you told me a year ago I would get to interview Will.I.am, I’d have laughed. The velocity at which we are moving is unlike anything I have experienced.

People with principles, passion and positivity. This is a high-performance culture where we work on outcomes and results. You have to believe in a particular way of working. We work in small teams, taking the sports team philosophy by bringing together people with complimentary technical skills and ability. We’ve assembled experienced banking, fintech and insurance leaders, alongside outstanding talent from start-ups, consultancies and agencies.

11:FS is unlike anywhere I have ever worked. It has been a wild ride so far. I joined 11:FS in September 2018. On day two I flew to Oslo to meet the DNB team and pick up my part of the negotiations that led to our current partnership. The negotiations were at an advanced stage when I came on board and it was great to have the team’s faith to jump right in.

This past 6 months have been the most exhilarating of my career.

A lot of people could find it daunting. People in Banking tend to think Fintech is sexy, fun, innovative. But the reality can be very different. It’s extremely tough work. We are at the leading edge of innovation, so most times it feels like we are building the plane as we are flying it.

We have an eclectic bunch here. Creatives, marketers, product, tech. Smart and driven people. We are now 150 staff and growing fast. A lot of people approach us direct because they follow the podcast, get excited by the work we do and feel a connection.

But we are just like any rapidly scaling business. We need a measured approach to Talent Acquisition and it is hard to find the right people when you are growing at scale. We are always open to people approaching us if they share our philosophy.

First of all let me say, I find it an honour people read my work. But it’s my belief that you influence by doing, not by talking. The greatest influence on my career is Adriana Pierelli, my old mentor at BNY Mellon. She was the person who backed me when I launched the innovation division at BNY. At the time it felt like everyone was mocking me as I got excited by APIs and the possibilities they could bring to the business.

Adriana believed. And opened the door for me to prove myself. All we need is an opportunity and a little bit of faith. And she gave me both. There are two life lessons I took from Adriana.

1) Practical Impact. You must make things happen.

2) Pay things forward.

It is so important to help people along the journey. To give your time, advice, connections. The platform I have been given is a privilege, meaning I can help more people than ever. That is the great thing about the 11:FS tribe. The Fintech Insiders show takes a lot of time, energy, money and resources to produce. But we do it for free because we truly believe in paying things forward and making digital banking better.

Dexter Cousins of Tier One People caught up with CEO and Co-Founder Martin McCann in Sydney recently to talk open banking and Lending as a Service.

Trade Ledger is a banking platform technology designed to help banks and large non-bank lenders provide any type of credit to businesses and corporations around the world.

We have built a global platform, technology which can be instantly deployed in any country. Matt Born (co-founder) and I come from Enterprise Technology backgrounds. Trade Ledger came into being because we both wanted build what we call a ‘true platform’. We see a lot of FinTech’s claiming to provide platforms which in our view are nothing more than technology stacks for a specific product. These are not true industry platforms.

Enterprise Software, which is essentially what we do, is one of the most complex and difficult markets in business. We’ve been building Trade Ledger for a market which didn't even exist when we set up the company. Globally the market we operate in is estimated as a $4 Trillion opportunity. Just the undersupply of credit for businesses globally is $2 trillion. That is the extent to which businesses are underserved with lending and capital. We call it ‘Lending as a Service.’ Nobody used the term when we set the business up two-and-half years ago.

Essentially LaaS is the outsourcing of the IT and operational requirements for the bank when it comes to lending. Typically, for a business to apply to a bank anywhere in the world for a line credit the average time to process the application is 90 days.

There’s about 30 hours of manual work for the customer plus 300 emails and 500 calls involved.

Trade Ledger eliminates the manual processes using API’s and accessing the banks data, completing the whole process in four minutes without a single document filled out.

Matt and I followed our own path when we started the business. Trade ledger was incorporated in August 2016 and we were supremely confident we were building the right solution at the right time for the right market. Joining forces is the first thing we got right. What Matt, the team and I are doing is really, really hard and you need at least two co-founders to tackle all of the challenges ahead.

The combination of us working together has proven to be a real positive for the company and our personal lives. Matt and I both have extensive experience in enterprise software. We both worked at SAP and we witnessed software disruption in other sectors, it was only a matter of time before the same would happen in banking.

The blueprint was already there from other industries, it was just a case of applying the strategy to the right niche. Forming our partnership, our timing and product-market fit are the keys to our success so far.

The business is now over 20 people, evenly split between London and Sydney. We've almost doubled the size of the company in the last three to four months. We are delighted with the ‘firepower’ we have hired into the business.

Firstly, we managed to find really high calibre senior engineers, the kind of people we think are potential game changers. In London, we’ve hired a CFO who is highly respected in the VC community. He will help turbo charge the growth of the business. We are embarking on Series A funding, having a CFO of the calibre we have is essential.

All this adds to the great talent we already have.

We don’t want a development center, and operational offices, we're trying to keep uniformity across the offices. Fundamentally I believe three things will give Trade Ledger long-term differentiation, in the market-place.

The people in the organisation

The culture of the organisation

And what I call the velocity, are we moving fast enough in the right direction?

I don't know if we are moving fast enough in the right direction yet, but we are accelerating.

The culture is very important to us. Matt and I have almost identical values and business ethics. Transparency is key to us, in terms of our business relationships and our people. We firmly believe when you're trying to grow something this new, this quickly, you are going to break things, frequently.

It's what you do when you realise you're going in the wrong direction, or you've broken something which counts. And recognising which things you can break and what you absolutely have to get right.

Living by this ethos creates a culture of high performance which is the edge for a company like ours. Frankly, the banks struggle to attract the kind of people required for a high growth, exciting tech startup like Trade Ledger.

So, banks will have to partner with Fintech’s to access the talent, innovation and execution required for this next paradigm of business we are entering. Big organisations just cannot achieve the velocity required to keep up with the pace of innovation today.

Primarily values and attitude. We don't focus on people's experience or their background, we focus on whether or not they would fit well with the team or will they be disruptive in the team. We love diversity. It does cause some challenges. The nature of diversity means it's harder to evaluate how someone will fit, in the context of values and ethics.

And then the other thing we look for is high potential or high propensity for success. What we've found is interesting. People who are under-experienced, properly motivated and show high potential are a much better fit for this organisation than people who've got proven experience.

People with high potential fit our culture and the way we work. They want to get ahead quickly, they appreciate the opportunity to be able to contribute and to learn. And they understand the value it creates for them as an asset that differentiates them in the market.

A good question. Can I say, it's really nice to be back in Sydney in the heat. From our perspective, Sydney is a great place to start a company. There's a lot of benefits to be found in the FinTech ecosystem but there are limitations.

The market itself is relatively small, compared to other markets globally. With our ambition to be a global software company, we don’t see significant market penetration in Australia. Banks in Europe and North America don’t see Australia as a market with enough scale, so it is difficult to get credibility as a global player being based from Sydney.

Why choose London? After some consideration and research, the legislative changes in Europe and open banking in the UK made London the ideal launch pad for the Trade Ledger platform.

There's massive investment from the banking sector in open banking technology, which from our perspective, is just API-based platform technology. The most innovative global bank transformation programs are happening in London. Lloyds alone has five transformation programs running, which, have a multi-year program budget of over 2.5 billion pounds. That's the scale of transformation technology that's happening in Europe and it's hard to find anything comparable happening anywhere in Australia.

If we want to be a global company, we have to win the European market and more specifically the London market. Open banking, GDPR and other legislative changes have created a seismic shift to data-driven lending in the business bank and SME funding market-place.

The UK market has been really interesting, and for us, it's great to have a ring-side seat to the first real implementation of open banking.

Year one was all about fixing the problems with the original scope, specification and approach to open banking. It went live late and there were a couple of issues with the implementation.

The challenge is shifting a heavily regulated market to a technology-driven business model in a record amount of time, it's never been done before. All of the interested parties are struggling to keep up.

The regulators are finding it particularly difficult to figure out what to do when things go wrong. Liability, specifically the daisy-chaining of liability and how to manage it, is turning out to be a significant problem. I think everyone has underestimated how big a shift this was going to be.

Australia being number two into open banking is perfectly positioned to come up with the best capability in the world. It is a highly ambitious plan to implement open data across all industries. Conceptually this is where the market needs to go to.

The Australian market has perhaps underestimated the difficulty of implementation challenges. Something of this scale needs a very strong governance process. It needs to have a very, very high degree of consultation with all of the stakeholder groups.

My fear is the original scope could be thwarted, and open data never actually achieves the ambition outlined in the original agenda. Specifically creating competition in banking.

I wrote an article outlining my fears, published in the AFR. From the feedback I received, maybe people misunderstood my intention. I do not advocate any particular solution, Trade Ledger will prosper regardless of what Open Banking journey Australia chooses. I feel strongly that we need to have the right discussion about the national interest, because this is a once-in-a-generational opportunity Australia can’t afford to get wrong.

If Australia gets open banking right, it is my firm belief we can export financial services to other countries on a scale rivalling the mining industry. And if we get it wrong, then the opposite is true. Digital financial services does not observe national borders. Regulation, which once protected national markets has now become a grey area.

We are in advanced discussions with significant global banks. It is a distinct change in strategy for us. There is a much higher risk involved and a lot more investment up front.

If Trade Ledger is to become what we intended from day one, a global top three in the category, then it’s the direction we need to go in. We don't shy away from risk or challenges, we embrace them, and we work harder, faster, and smarter to try and move in the direction we want to go.

We are laser focused on building a ‘smart’ banking experience that will change people’s relationship with money for the better - fostering financial wellness.

Andy Taylor is an Aussie FinTech pioneer. He is one of the original founders of Society One, bringing peer to peer lending to the Australian market. Andy's latest venture, Douugh is his most ambitious project yet, a next gen Neo Bank with an AI first approach. Set to launch in the US through a partnership with Choice Bank, Douugh announced a partnership with Regional Australia Bank just this week.

Tier One People CEO, Dexter Cousins brings you this exclusive interview!

Unlike ‘traditional’ Neobanks, who are taking a mobile first approach and applying for their own banking licences to sell traditional bank products. Douugh is a technology company taking an AI first approach to building a proprietary software platform, partnering with a bank to provide it with deposit taking capabilities and a balance sheet. The company is pioneering a new business model focused around delivering financial wellness for it’s customers.

Correct, it allows us to offer a fully insured bank account and Mastercard debit card, without the need to become a licenced bank ourselves. This frees us up to focus on building out a technology company, innovating on the customer experience software layer through an AI first approach, utilising open API’s.

It’s been very difficult and time consuming to find the right partner in Australia. We wanted to find someone who respected our independence, shared our values and capable of supporting our ambitious product and growth plans.

Correct, it’s ultimately a wholesale partnership. The Douugh branded bank account will be ‘issued’ by Regional Australia Bank on the backend, customers funds will be held by them, protected by the government guarantee on deposits upto $250,000. The entire customer experience is managed by us through our mobile app and customer support centre.

This is a similar commercial partnership model to what Up has with Bendigo Bank. Meaning, we act as an ‘authorised representative’ of a bank, rather than getting our own banking licence. The partnership with RAB is very much the missing piece. The ability to offer a fully insured bank account and debit card means we can now launch in Australia.

We do expect people to dip their toe in the water initially to test our technology and gauge the impact it will have on their daily lives. I think we will need to work hard to win the right to people’s salary deposits. We believe people will hold multiple bank accounts in the future.

The battle ground is winning the right to the salary deposit and everyday expenditure. We do allow customers to connect their existing bank accounts and credit cards, so we can give them a 360 degree view to truly understand their financial position. This is where the strategy of becoming the ‘financial control centre’ for our customers becomes very important.

We are laser focused on building a ‘smart’ banking experience that will change people’s relationship with money for the better - fostering financial wellness.

People now expect transparency, insight, personalisation and autonomy. They want to understand the opportunity cost of their financial decisions today and what it means for their future, delivered through a seamless, intuitive and frictionless experience.

Banks today do not offer this. They are analogue in their offering, and are not incentivised to offer this kind of service and business model, as they are bogged down by legacy systems and operational models, totally reliant on pushing traditional credit products to deliver short-term profitability, as opposed to generating positive financial outcomes for their customers, taking a longer term view.

People are now aware of this (as exposed by the Royal Commission), and are looking to technology to help them. We believe this sentiment is consistent around the world.

Ultimately, it’s about understanding people’s emotional drivers. Money is one of the most powerful forces behind emotional state of mind, and the majority of people's relationship with money is based on fear and anxiety. We plan to tap into this in a positive way and change the narrative, supporting and educating our customers to get ahead and achieve their goals. So, they can live happier and healthier lives. Rather than be bogged down, living paycheck to paycheck .

This is where we see our AI assistant Sophie really playing a positive role and forever changing the game. Taking on the responsibility of a frictionless, autonomous money manager. Working on behalf of our customers to make money work for them, not the other way around.

We believe this will have a major and lasting impact on society as a whole. This is the legacy I want to leave behind.

We have strong demand in the US from the little marketing and PR we have done, with thousands of people signed up to our waitlist.

We have started to raise our awareness in Australia via our partnership with Crowdfunding platform Equitise. We aim to build a foundation community. With thousands signed up on our waitlist so far. We will look to ramp up our pre-launch marketing efforts from here on in.

We are targeting a late Q4 launch this year. Yes the space is hotting up, and we are keen to cut our teeth in this market because it is our home, and we believe Australia (like the US), has a very big problem to solve in terms of the spiralling household debt levels and overall financial health.

Importantly, we view Australia as a key strategic market for R&D purposes, as it is continues to lead the way in mobile payment adoption in the western world.

Not really, I believe it is much easier for us as we don’t need to get distracted by the fact that we are wanting to be a bank. Becoming a bank does not solve the problem. We have a much more succinct, purpose based marketing message and mission than other ‘Neobanks’.

The hook is that we are looking to pioneer a new business model to make the world financially healthier through a proprietary software platform. We are helping people pay off debt, spend less, save and build wealth autonomously via a ‘smart’ bank account offering, powered by AI.

The crowdfunding is going really well, demand is strong. We wanted to use it as a vehicle to attract a foundation customer base and community in Australia that are passionate about our cause and business. We see this as a better fit at this stage in our lifecycle.

We are on a path to list on the ASX this year, this funding round will allow us to staff up to launch and scale the US business.

We see much bigger potential for Douugh, as we are operating this as a global banking platform from day one, beginning in the US. The opportunity is obviously significantly larger as we scale up in this market and beyond. Everyone needs a bank account!

We truly believe we can scale to reach 100 million customers by 2030 and we are motivated to show the world that Australia can produce world class consumer technology companies.

Very much so. I’ve always been driven to build a global consumer software company that structurally disrupts the status quo. The mission was always to provide consumers a better experience than offered by the banks, with a business model that is aligned to positive financial outcomes. With Douugh, we are building a product that is co-created with customers from a passionate community.

Look Who's Charging had a stellar 2018 with numerous awards, accolades such as featuring in KPMG's FinTech 100 and commercial success with two of the Big 4 Aussie banks becoming customers. Sibos and Money 20/20 helped put Look Who's Charging on the global FinTech map.

Tier One People's Dexter Cousins talks with Co-Founder David Washbrook to talk about a fine year and a Vegas road trip!

Look Who's Charging is all about improving the customer experience through enriching bank statement transactions. Everyone has experienced the issue. You look at your bank statement and half the time it may as well be written in foreign language. You see C&A WALKER PTY LIMITED, for example. A Google search brings up hundreds of businesses none of which you recognise.

So, you phone your bank. Twenty minutes on hold, verify yourself, bounce between two or three different departments, and at the end of all of that, more often than not the bank can't do anything other than a Google search themselves. In fact, two of the Big Four bank's contact centres don't even have access to Google.

It is a very frustrating problem for the consumer, leaving them feeling genuinely worried that they might be subject to fraud. It's also a very expensive problem for banks. Ten percent of all the calls to a banks contact centre relate to queries on unrecognised transactions. Sixty percent result in manual chargebacks, costing a bank around $80-$90 dollars for each one.

We improve the customer experience and save banks millions of dollars in costs through reduced calls and chargebacks.

It was two-fold. My fellow Co-Founder, Stuart, was running a separate business at the time. He became increasingly frustrated with trying to reconcile his accounts due to the large number of confusing descriptions (most small accounting packages use bank statement data).

At the same time, I inadvertently committed a friendly fraud. I disputed a transaction with my bank as didn't recognise the merchant. I genuinely thought it was a fraud. I got my money back for the transaction which later turned out to be legitimate.

We did some further research and we quickly realised that unrecognised transactions were a big issue for consumers and also a very expensive problem for banks. Australian banks alone are spending somewhere in the region of $200m a year dealing with the problem.

A lot of Fintech businesses can often be complex to explain. You are correct in that ours is very simple. However, solving the problem is far from simple. Lots of people have tried before. We know big banks who have tried; large software companies who have tried; other Fintechs who have tried.

They throw a team of people at it, work on the problem as a project, get something that is fifty, sixty percent of the way there, but unless you're maintaining the data, staying on top of it, it quickly becomes redundant. Our senior team has over 80 years’ experience working in IT and on big data problems, and this is by far the most complex problem any of us have ever come across.

The idea is not new but being able to execute on the idea, that's where we have achieved something that no one else has managed to. We return over 180 different fields on a merchant and our accuracy is >95%. Most other offerings simply return one field (being category) and the accuracy is far lower than us. Banks are pushing our data to one of the most important consumer touch points being the transaction feed of digital applications; they have to have trust and confidence in our product.

Our solution has three core components, all using proprietary market first technology:

Merchant database. We have compiled a database of the 1.3m card accepting merchants in Australia. Over 1m lines of code and we draw on over 150 different data sources to ensure we always have the most up to date information.

To solve the problem you need to understand both the legal entity information and trading entity information for a merchant. Some businesses out there know the legal entity information of a company, and some know the trading entity information, but from what we can tell we are the first business to build a complete legal and trading view of a merchant.

Search engine. We have developed a proprietary search engine to match the 20m+ transactions descriptions (per debit and credit card statements) back to this database of 1.3m card accepting merchants.

Robust architecture. Our robust architecture enables our data to be pushed to bank’s digital applications in real time. Our API can return data on up to 50 transactions in less than 30ms.

Most importantly you need a solution that solves a genuine customer pain point, saves the bank money or improves regulatory compliance. Tick two or three of these boxes and your chances of working with a bank significantly improve.

But you also have to have the correct governance, compliance and risk management protocols in place to pass their security and procurement checks.

First conversation to go-live with NAB took seven months for us, which was fantastic, especially as they were our first customer. NAB had identified the problem of unrecognised transactions as a top consumer pain point and one that was costly for the bank. We offered a unique, market-first solution and NAB was able to move quickly to bring this to their customers.

In general the sales cycle with a big bank, or any bank for that matter, is relatively long. Most importantly you need a solution that solves a genuine customer pain point, saves the bank money or improves regulatory compliance. Tick two or three of these boxes and your chances of working with a bank significantly improve.

But you also have to have the correct governance, compliance and risk management protocols in place to pass their security and procurement checks. You can have the best product in the world but if you don’t have the right risk management procedures in place then you won’t go-live with a bank. The Hayne Commission and recent high-profile data breaches from companies such as Equifax, British Airways and Marriot-Starwood Hotels make it increasingly harder.

Finally, you must make your solution as easy as possible for a bank to integrate with. Our solution is at the easier end of the spectrum, but it's still a lot of work for a bank to integrate with a third-party. If your solution is going deep into banking systems, even if it's the greatest product in the world, it makes it a much harder task to partner with a bank.

Absolutely. It has been a really good win for us, especially as we were selected without even applying. We've been fielding a lot of inbound inquiries from all around the world after the report was published. I think we were one of only seven Australian companies to make the list.

We're almost at thirty people now, twelve people onshore and another fifteen people offshore. We will continue to hire people in 2019. The decision has been made to draw on the best expertise from people around the world as there is a lot of complexity to our solution. Finding the skills onshore can sometimes be challenging; machine learning, AI, the search components of our architecture. We've developed a hybrid model with three very senior developers onshore managing the specialist skill sets from around the world and bringing everything together to make the solution work.

Culture becomes a critically important element in growing a business, and the culture is really determined by the quality of people that you hire. If you have a start-up with some traction, you're building something exciting and people can get involved with growing the business, it’s generally very appealing to great talent, especially with the buzz around tech at the moment.

Money 20/20 brought together over 15,000 people from leading Banks and FinTech companies from around the World in Las Vegas during the final week of October. We were lucky enough to get a spot on stage and a stand at Money 20/20. Look Who’s Charging was selected, as one of only 24 companies, out of over 800 from around the globe, to pitch on centre stage. If you're a tech business you really have to think globally from day one. Money 20/20 provided the perfect springboard to explore off-shore expansion.

Immediately after our presentation there was a long line of companies queuing at our stand up saying 'we need this in the market. No one is focused on the problem.' The greatest interest came from Canada and the UK, they're a bit more advanced with digital banking than the U.S.

We expected to go to Money 20/20 and find 10 other companies doing what we do. However, despite a high demand for transaction enrichment, we were unable to find any company who has or is trying to provide a solution quite like ours.

More generally in the banking and the payment space it seems that the U.S. is definitely lagging Australia. For example, we have contactless payments rolled out across the country. I personally haven't taken cash out in Australia since 2017 and I haven’t had any problems. I solely rely on my phone and my watch now.

The U.S. still primarily has legacy infrastructure where you have swipe your card, sign, and show ID to verify your signature. A number of merchants also still don’t accept card payments. This makes it much harder to enact behavioural change and get people to switch to a digital wallet.

The environment in Australia is the perfect testing ground for financial services companies to get their product to market. If you can perfect your product here, there's a massive opportunity to then launch in the U.S. and other markets like Europe.

However, I think that we have got to go to them because they're generally not coming to Australia to find out about us. The support is there for Australian FinTechs to expand, for example, Austrade’s Global Landing Pads and the recent UK FinTech Bridge. In addition, if you have a product in market, and that product is scalable, you shouldn’t have any issues raising money in the markets like the U.S.

We are super excited about the coming 12 months. We’re making good progress in the Australian market having on-boarded two of the big four banks and a number of small banks. This will remain our number one priority in the short term.

There’s also a growing number of use cases for the technology – enriching transactions within digital banking applications is just the tip of the iceberg. For example, one of the top findings from The Hayne Commission was that banks are generally good at verifying income on loan applications but that they were generally poor with expense verification. Our technology can quickly and easily automate the verification of both income and expenses to a high-degree of accuracy.

Overseas expansion definitely remains our longer-term goal. We’ll likely look to expand into the Canadian and U.K. markets next as they are similar in nature and size to Australia. We're very excited by that prospect and opportunity.

Raiz Invest (previously Acorns Australia) launched in 2016, quickly amassing close to one million users.

George Lucas, CEO is one of the more experienced founders in the FinTech NextGen series. Many CEO’s in financial services struggle to relate to the Millennial market, not so George and his Raiz Invest team. Discover his secrets in this interview with Dexter Cousins of Tier One People.

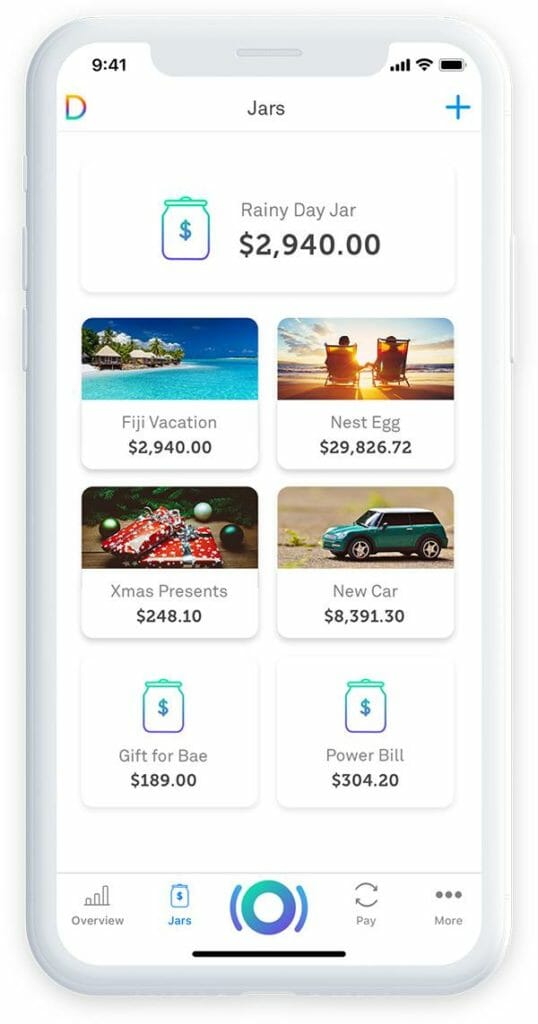

George: Raiz Invest is a micro investing platform, enabling users to invest in the markets with as little as five dollars all through an app on your mobile phone. Put simply, we enable users to save in the background of life. Raiz educates a potential investor setting aside the misconception that investing and financial planning is too difficult to get involved in.

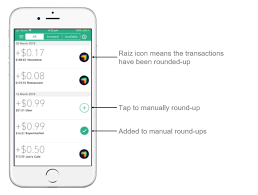

We have created multiple ways for our users to save and invest. The first way is through a lump sum investment, you can deposit money into the investment account at any time. The second way is to set up a savings plan or a recurring investment, where an automatic payment goes into the account. The third way is the round up feature which we have become well known for.

The round up feature tracks your spending on your debit cards, bank accounts, et cetera and rounds up transactions to the nearest dollar. If you spend $3.50 on a coffee, 50 cents is invested into your Raiz account. People can start saving without having to think about or setting savings goals. It just happens in the background as you get on with life.

George: The traditional way of investing requires 5000 dollars to get started. You need to complete a load of forms, pay for advice, find a broker. We wanted to simplify the process, reduce the inertia people experience when making investment decisions and make saving and investing super simple.

The plan from day one was to create something where a customer could invest as little as five dollars, sign up, in minutes through a mobile phone and access their savings whenever they wanted.

Back in 2014 we started explaining the concept to people and felt we had something special. Once people began registering for the pre-beta testing, the feedback we received was even more encouraging. People loved being able to invest for as little as five dollars. The ability to link accounts, round up spending and invest automatically resonated particularly with the millennial generation.

We officially launched in February 2016 in Australia, as Acorns. In the lead up to the launch, we were extremely busy building the software, applying for licenses, developing the product and platform security. It's a big job. And we wanted to ensure the product we launched was fully functional. We were still just a start-up of three people when we launched.

George: We've simplified the choices and made investing accessible to everyone. The product has gained a lot of traction with Millennials, more than 900,000 people have downloaded the app and we are managing more than $250 million in funds.

By simplifying the choices, making it very easy to sign up and offering round ups, investing is hassle free. But we have also developed a lot of loyalty within our customer base. That is one of the coolest things, how engaged our customers are with the app. Engagement is key and we are always listening to our customers.

As an example, a customer requested a socially responsible investment option, so we created one for them with the Emerald portfolio. If you look at our product development releases to date, some examples being Raiz Kids, Raiz Rewards, My Finance and most recently Raiz Super, it has all been driven by our customers.

Maybe the difficulties other finance companies experience tapping into the Millennial market are self-inflicted? Let’s face it, Financial Services in Australia is heavily dominated by middle-aged men. We have seen several instances in the last twelve months where young people feel the people in power are out of touch with the modern world.

Rather than lecturing our customers on whether they should spend their money on Avo and Toast, we are providing them with the tools to save for a home deposit, or a holiday, or their kids school fees. Millennials are no different to any other customer. Just listen, give them what they need and treat them with respect.

George: When you offer investment products geared towards savings it is best to have a conservative investment strategy. But when there are market downturns it can present challenges. The major banks in Australia have tried to make life difficult for us, as we are disrupting a market they probably didn't know existed.

Despite the challenges, we’ve built an ASX listed Investment business with a young team of only 16 permanent staff, this includes 4 developers, 4 customer support team members, the rest of our team are across marketing, research, and operations. We outsource when we need to as the workflow and demand isn’t linear.

For want of a better word, Raiz Invest is an agile organisation. And so being an agile organisation also means we have a very flat structure. We have managed so far to maintain a high level of customer experience even though we run lean. But that's because the machine is very automated. We are not encumbered by legacy systems and outdated technology.

Our people seem to enjoy the challenges of a FinTech startup. It's very laid back, no one comes in to work in a suit and tie, we’re not that type of financial services organisation. It's a very young business, most our people are under the age of 30. And they seem to be laughing a lot, so they can't be that unhappy!

At the end of the day, there have been many challenges and it has not exactly been easy. We had to make sure we had a clear marketing plan to acquire customers in line with the highly regulated industry. And at the same time, we had to make sure we had enough funding.